Choosing the right forex broker can be overwhelming, especially with so many options available. This blog post will guide you through the essential factors to consider when selecting a forex broker, ensuring that you make an informed decision tailored to your needs. Whether you’re a seasoned trader or just starting out, these tips will help you find a trustworthy partner for your trading journey.

Understanding Forex Brokers

Forex brokers serve as intermediaries between traders and the forex market. They provide the platform and tools necessary for trading currencies. But not all brokers are created equal. The right broker can enhance your trading experience, while the wrong one can lead to unnecessary stress and potential losses.

Reputation Matters

When it comes to choosing a forex broker, reputation is key. Look for brokers with a solid track record and positive reviews from other traders. Online forums, social media, and review websites can provide valuable insights into a broker’s reliability and customer service.

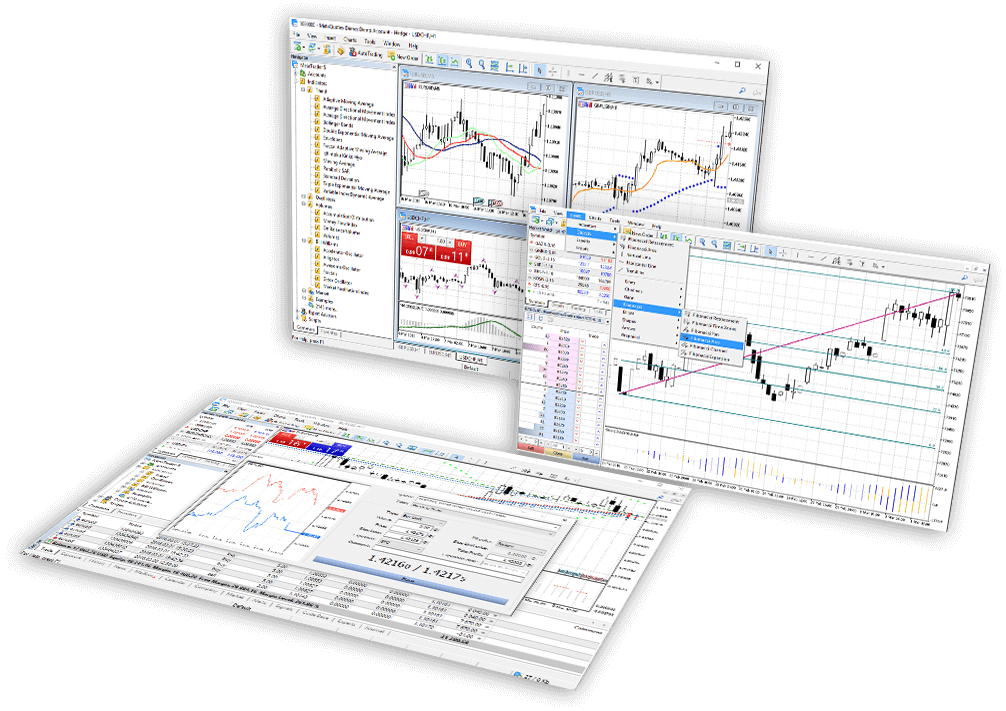

Trading Platform and Tools

A user-friendly trading platform is essential for successful trading. Ensure that the broker offers a platform that is easy to navigate and equipped with advanced tools for analysis. Popular platforms like MetaTrader 4 and MetaTrader 5 are widely regarded for their comprehensive features.

Range of Currency Pairs

Different brokers offer varying numbers of currency pairs for trading. If you have specific pairs in mind, make sure your chosen broker provides them. A diverse range of currency pairs allows for more trading opportunities and better diversification.

Customer Support is Crucial

Excellent customer support can make all the difference in your trading experience. Look for brokers that offer responsive and knowledgeable support teams. Live chat, phone support, and email assistance should be available to address any issues promptly.

Fees and Commissions

Trading costs can vary significantly between brokers. Pay attention to spreads, commissions, and any hidden fees that may affect your profitability. Transparent pricing structures are a sign of a reputable broker.

Account Types

Brokers often provide different account types to cater to various trader needs. From standard accounts to premium accounts with additional features, select an account type that suits your trading style and financial goals.

Deposit and Withdrawal Methods

Convenient deposit and withdrawal methods are essential for smooth trading operations. Check if the broker supports your preferred payment methods and ensures quick processing times for deposits and withdrawals.

Educational Resources

A good broker should offer educational resources to help traders improve their skills. Look for brokers that provide webinars, tutorials, and market analysis to keep you informed and up-to-date with market trends.

Security and Privacy

Security is paramount when dealing with financial transactions. Ensure that the broker uses advanced encryption technology to protect your personal and financial information from unauthorized access.

Mobile Trading

In today’s fast-paced world, the ability to trade on-the-go is crucial. Opt for brokers that offer robust mobile trading platforms compatible with your smartphone or tablet, allowing you to manage your trades anytime, anywhere.

Demo Accounts

Demo accounts are invaluable for testing a broker’s platform and practicing trading strategies without risking real money. Choose a broker that offers a free demo account to get a feel for their services before committing.

Transparency and Trust

Transparency is a hallmark of a reliable broker. Ensure that the broker provides clear information about their terms and conditions, trading policies, and any potential conflicts of interest.

Staying Updated with Market News

Access to timely market news and analysis can give you an edge in trading. Select brokers that offer real-time news feeds and market updates to help you stay informed and make informed trading decisions.

Conclusion

Choosing the right forex broker is a crucial step in your trading journey. By considering factors such as reputation, trading platform, customer support, fees, and security, you can find a broker that meets your needs and helps you achieve your trading goals. Remember, a well-informed decision is the foundation of successful trading. Happy trading!